Introduction

Projections indicate that, without adaptation, African agricultural productivity will likely decrease during the 21st century as a result of climate impacts, increasing the risk of food and nutritional insecurity throughout the continent (Challinor et al., 2014; Müller et al., 2011; van Ittersum et al., 2016).

An opportunity for new livelihood strategies, and market growth

But while changes in climate can have negative impacts on the suitability of certain crops in some areas, the opposite may be true for other crops in other areas. This presents an opportunity for new livelihood strategies, and market growth. Making the most of these opportunities is just as important as adapting to the negative impacts of climate change.

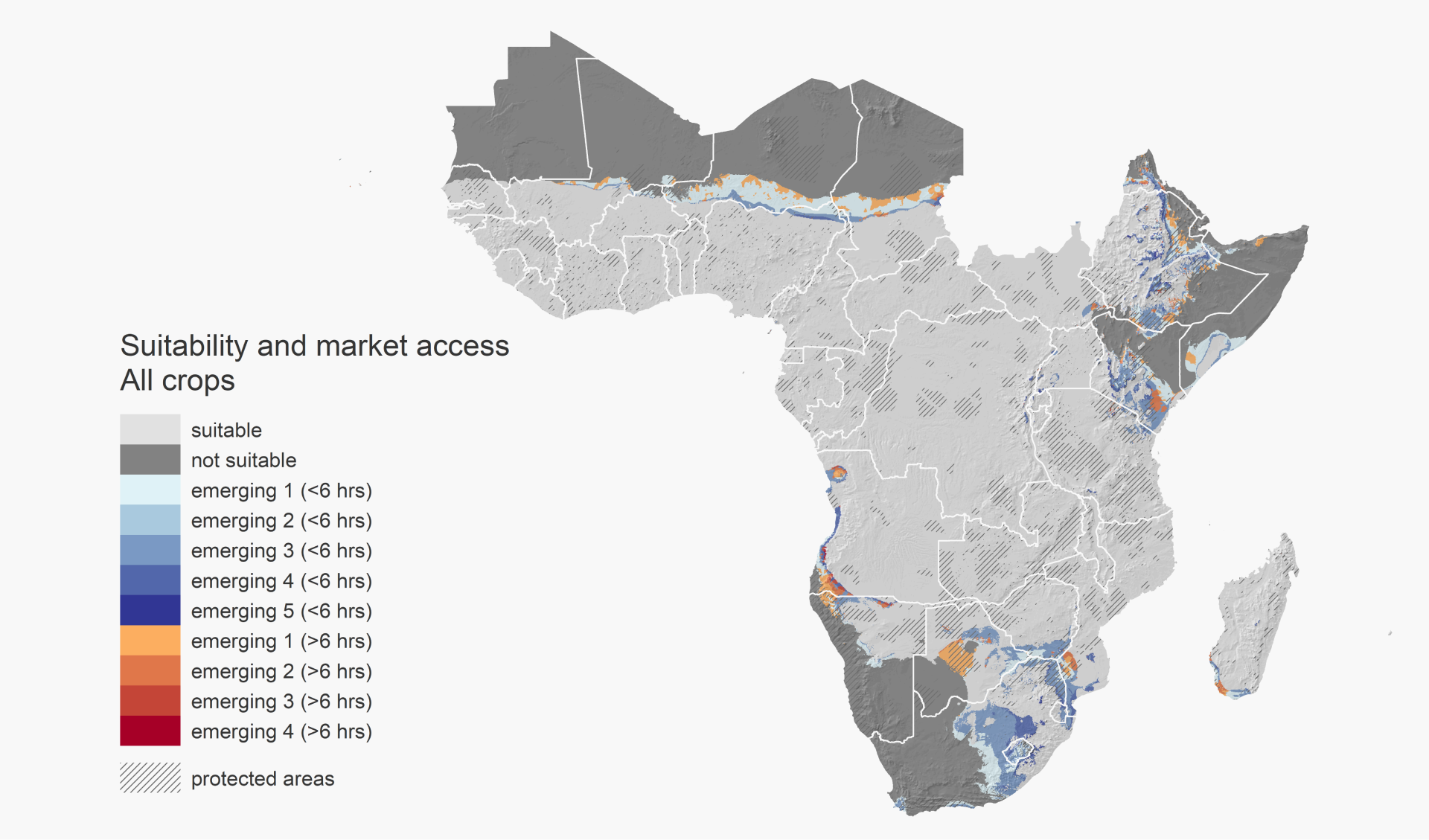

Map 1 Where suitability for crop cultivation is projected to increase, there may be emerging opportunities for smallholder farmers. Shown are different levels of opportunities layered with accessibility to markets. Blue indicates where market accessibility is high (less than six hours of travel time), while orange-red indicates limited accessibility to markets (more than 6 hours of travel time). Emerging opportunities are categorized from 1 (highest risk) to 5 (lowest risk), based on their projected suitability under climate change in the 2030s. Light gray areas indicate areas in which crops are suitable in the baseline and either remain suitable or decrease suitability by 2030. Gray-striped polygons highlight protected areas. Dark gray areas are those in which no rainfed cropping is possible.

The vast majority of these opportunities are in areas considered to have relatively high market access

Map 1 shows potential opportunities that emerge from increases in crop suitability*. A number of areas emerge across sub-Saharan Africa. Notably, the increased rainfall of the eastern Sahel and East Africa increases the suitability of some (but not all) of the crops, which move mostly from being unsuitable to marginally suitable, or from marginally to moderately suitable.

The vast majority of these opportunities are in areas considered to have relatively high market access and where there are no major land-use restrictions, such as high forest cover or protected areas. Highland areas in Kenya and Ethiopia, however, see increases in average crop suitability in many areas that are either protected or have high forest cover.

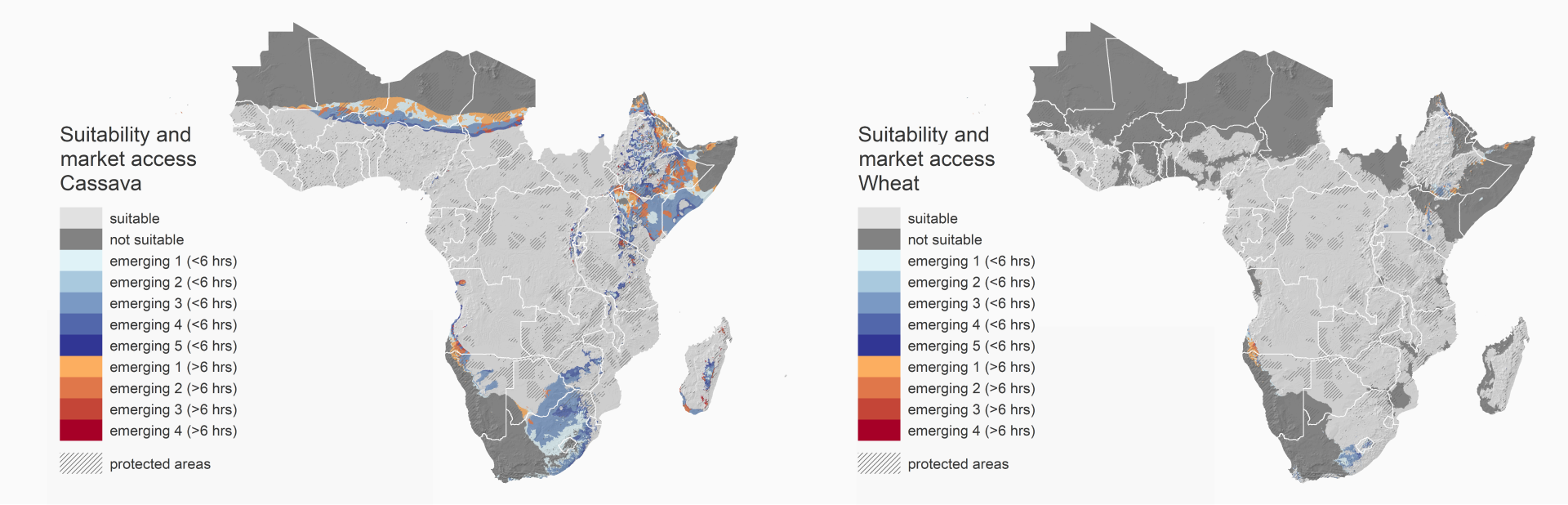

Analysis of individual crops reveals what the opportunities are. Map 2 shows hotspots where farmers could benefit from expanding cultivation of cassava.

Map 2 (left) Suitability and market access of cassava, Map 3 (right) Suitability and market access of wheat

Cassava production might be an excellent opportunity for improving rural livelihoods

In sub-Saharan Africa, cassava is primarily a food crop, although it has substantial untapped potential for starch production for industrial use (Li et al. 2017; Poku et al., 2018). In Zimbabwe, where we identify significant opportunities emerging for cassava, Kleih (1995) estimated starch demand to be in the region of 7,700 tonnes of chips, and demand for ethanol equivalent to 240,000 tonnes of fresh roots. Cassava has also been identified as a source of calories for subsistence farmers in marginal areas where most other crops fail (Jarvis et al., 2012; Kamukondiwa, 1996).

If these areas do not disturb strategic ecosystems suited for conservation and forestry, then cassava production might be an excellent opportunity for improving rural livelihoods. Furthermore, existing or new cassava farmers will need relatively easy access to inputs, seeds, and financing in order to foster enterprise. Perhaps most importantly, they will need access to markets with sufficient demand to make the business opportunity attractive. Any such areas with low travel time to major cities would likely be hotspots for such investments.

It would be crucial to understand and map out the existence of the necessary conditions for expanding production of these crops

Strategic hotspots for the development of new value chains and the growth of agricultural markets are similar for cassava, chickpea, beans, pigeon pea, soybean and sesame seed that are mostly located in South Africa, Botswana and Zimbabwe. For crops such as rainfed wheat, on the other hand, which primarily experience reductions in crop suitability, our model-based estimates indicate that there would be few opportunities for expanding cultivation.

Further research would be needed to better understand the implications of the opportunities for improving rural livelihoods in these specific zones. In particular, it would be crucial to understand and map out the existence of the necessary conditions for expanding production of these crops. Such conditions would include access to credit and appropriate infrastructure, and availability of seed, other inputs, training and effective extension systems.